We’re getting closer to a big wave of auto repossessions.

— CarDealershipGuy (@GuyDealership) December 26, 2022

November auto loan data shows a *very notable* jump in percent of Deep Subprime borrowers that are 60 days past due 🥴 (8.2%, to be exact!)

Here’s the breakdown:

Monday, December 26, 2022

8.2% jump in November of Deep Subprime borrowers . . . are 60 days past due

Tuesday, December 6, 2022

Buy an Oil Tanker

The deuce you say? Who couldn't see this coming? https://t.co/CPkc0cHvCn

— Tom Luongo (Give Deflation a Chance!) (@TFL1728) December 6, 2022

Wednesday, November 30, 2022

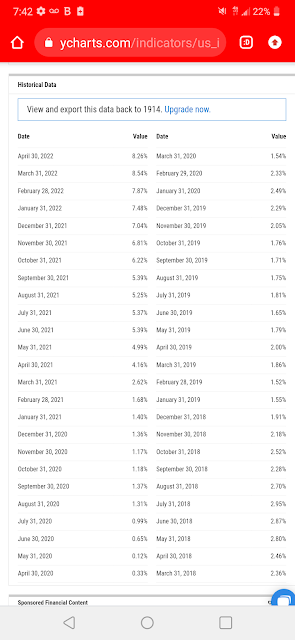

% Increase over the last 3 years... US Money Supply (M2): +40%. US Home Prices (National Index): +41%

% Increase over the last 3 years...

— Charlie Bilello (@charliebilello) November 29, 2022

US Money Supply (M2): +40%

US Home Prices (National Index): +41%

Coincidence?

Charting via @ycharts pic.twitter.com/JmJz5OTQpw

Friday, November 18, 2022

Used car prices are now down 14% over the past year, the largest YoY decline on record with data going back to 2009

Used car prices are now down 14% over the past year, the largest YoY decline on record with data going back to 2009. This was a leading indicator of higher inflation rates in 2020 and the recent downturn is likely a leading indicator of lower inflation rates to come. pic.twitter.com/N1e7v9ZNjM

— Charlie Bilello (@charliebilello) November 18, 2022

The collapse in the freight market has created a scenario where spot rates are below truckload carrier operating costs - we could see a massive purge of capacity over the next two quarters.

Have seen this movie before, small carriers get flushed out. Market bounces back and rates go through the roof with limited capacity available.

— El Jefe (@___El_Jefe_) November 18, 2022

Havent seen rates this cheap in years

U.S. homebuyer must now earn $107,281 to afford typical $2,682 monthly mortgage payment, up 45.6% from $73,668 a year ago

U.S. homebuyer must now earn $107,281 to afford typical $2,682 monthly mortgage payment, up 45.6% from $73,668 a year ago per @Redfin pic.twitter.com/7d7aaqXmwo

— Liz Ann Sonders (@LizAnnSonders) November 18, 2022

Wednesday, November 9, 2022

https://markcrispinmiller.com/

https://alterra.wd1.myworkdayjobs.com/WinterParkResort/job/Winter-Park-CO/Email-Marketing-Specialist---Year-Round_JR101030?source=Jobget.

https://www.independentsentinel.com/mrna-spike-protein-found-in-dead-mans-brain-and-heart/.

https://www.lifesitenews.com/news/10000-abortions-prevented-in-first-two-months-after-roe-v-wade-overturned-report/?utm_source=featured-news&utm_campaign=usa.

https://denutrients.substack.com/p/spike-protein-risks-aids-summary-page.

https://www.orwellfoundation.com/the-orwell-foundation/orwell/essays-and-other-works/politics-and-the-english-language/.

https://www.lewrockwell.com/2022/10/jeff-deist/the-front-lines-of-the-language-wars/

https://markcrispinmiller.com/.

https://nalert.blogspot.com/2022/08/the-corruption-of-medicine_13.html?m=1.

https://www.lewrockwell.com/2022/08/no_author/dissident-dialogues-cj-hopkins/.

https://tomrenz.substack.com/p/justice-accountability-is-coming

https://fee.org/articles/the-most-prosperous-ancient-nation-you-ve-never-heard-of/

https://danielmcadams.substack.com/p/the-end-of-the-world-fin-du-monde.

https://denutrients.substack.com/p/spike-protein-risks-aids-summary-page.

https://www.bodyandbeans.com/natural-ways-to-get-rid-of-skin-tags-fast-and-naturally/.

https://archive.ph/gDrho.

https://www.frontiersin.org/articles/10.3389/fmed.2022.843793/full

https://www.armstrongeconomics.com/armstrong-in-the-media/interview-russia-the-key-to-the-great-reset-cbdcs-sovereign-defaults-more/.

https://futurism.com/the-byte/army-gene-hacked-disease-mosquitoes-infertile.

https://archive.ph/gDrho

https://www.armstrongeconomics.com/markets-by-sector/energy/biden-has-ensured-the-fall-of-the-usa/

https://www.lewrockwell.com/political-theatre/the-us-is-about-to-run-out-of-fuel/

Tuesday, November 8, 2022

Commodities were the strongest performers during the stagflationary 1970's

Commodities were the strongest performers during the stagflationary 1970's pic.twitter.com/VRsKtOrhqJ

— Gigi Penna (@giginator_) November 8, 2022

Sunday, October 30, 2022

US housing demand is absolutely collapsing. Pending sales down -35% in the last 12 months.

US housing demand is absolutely collapsing. Pending sales down -35% in the last 12 months. pic.twitter.com/oblgGzPRcS

— Charles Edwards (@caprioleio) October 30, 2022

Saturday, October 22, 2022

The Public Polling Project is the only successful portfolio solely funded by the American Public

The Public Polling Project is the only successful portfolio solely funded by the American Public, and I could not be more proud of that.

— Rich Baris "The People's Pundit" (@Peoples_Pundit) October 22, 2022

Public Polling Project recommended by Rich Baris.

A sampling of Rich's blog but that's not where his content is at. His content is on Locals.

And don't forget Rich's YouTube channel.

Republicans Lead By Expanding Margin on Generic Ballot - https://t.co/Hji5x9TCoC

— Mike Walgenbach (@mwalgen44) October 22, 2022

Digital Nomad Visa In Grenada

Obtaining Your Digital Nomad Visa In Grenada #expat #DigitalNomad #Grenadahttps://expatmoney.com/blog/obtaining-your-digital-nomad-visa-in-grenada

— Mikkel Thorup | Author & Podcast Host (@ThorupMikkel) October 21, 2022

Funny, or tragic, that you can't find a consistent or standardized definition of residency. This from the IRS.

Wednesday, October 19, 2022

UST 10 year 5% next?

UST 10 year 5% next? pic.twitter.com/HddeUe8uB8

— Eric Yeung 👍🚀🌕 (@KingKong9888) October 19, 2022

Tuesday, October 18, 2022

Renters Surpass Homeowners In 41% Of Zip Codes In The 50 Largest US Cities

Renters Surpass Homeowners In 41% Of Zip Codes In The 50 Largest US Cities https://t.co/VyAj3NHqgP

— zerohedge (@zerohedge) October 18, 2022

Sunday, October 16, 2022

MAY 2022--OCTOBER 2022: 15% Price Drop in Northern California

📉Fastest Housing Crash Markets.

— Nick Gerli (@nickgerli1) October 15, 2022

15% Drop in Sale Prices in Oakland, San Jose, & Austin in ONLY 5 MONTHS.

That's warp speed for a Housing Crash. Some of these markets could be down 20-30% by Year End.😬 pic.twitter.com/QZsE1pwngl

Sunday, October 9, 2022

Shocking Collapse in Mortgage Applications last week.

📉Shocking Collapse in Mortgage Applications last week.

— Nick Gerli (@nickgerli1) October 8, 2022

Purchase Demand at lowest level in a DECADE. Comparable to lows in 2010 during last Housing Crash. pic.twitter.com/gVDWmnQIZy

Sunday, October 2, 2022

"Emergen-C" vit. C drink is owned by +Pfizer? And contains GMOs?

PSA: The popular "Emergen-C" vit C drink is owned by Pfizer & contains GMOs! 🤢🤮 pic.twitter.com/p8TtV8qJ0v

— Natural Immunity FTW (@NaturallyFTW) October 2, 2022

DEFINITELY NO INFLATION: Home prices are selling for 9.5 times the average income, the highest home price to income ratio ever

Home prices are selling for 9.5 times the average income, the highest home price to income ratio ever, per Eric Basmajian.

— unusual_whales (@unusual_whales) October 2, 2022

Saturday, October 1, 2022

Home Inspection in Brighton

I was looking at this opening for Home Inspection in Brighton, and the position asked for a CPI, Certified Professional Inspector. ASHI is the American Society of Home Inspectors. The test is 200 questions and 4 hours long.

Wednesday, September 14, 2022

US rental inflation accelerated in August as shelter costs rose 0.7%,

US rental inflation accelerated in August as shelter costs rose 0.7%, marking the biggest monthly increase since 1991.

— unusual_whales (@unusual_whales) September 13, 2022

Friday, September 2, 2022

For the first time since March 2021 (18 months), the average home is selling below its list price...

For the first time since March 2021 (18 months), the average home is selling below its list price... https://t.co/BDt1giDmD0 pic.twitter.com/EomJqHTOMF

— Charlie Bilello (@charliebilello) September 2, 2022

Friday, August 19, 2022

Back then, national home prices subsequently fell 25% to their low in Dec 2011. Today, the price declines have just begun.

US Housing Affordability is at its lowest level in 33 years, below the July 2006 low which was at the peak of the last housing bubble. Back then, national home prices subsequently fell 25% to their low in Dec 2011. Today, the price declines have just begun.

— Charlie Bilello (@charliebilello) August 19, 2022

Charting via @ycharts pic.twitter.com/HYoafwy4br

Thursday, August 18, 2022

Sales plunged by 5.9% in July from June, the sixth month in a row of month-to-month declines, and by 20% from a year ago

The red-hot housing market turns into a housing recession.

— Wall Street Silver (@WallStreetSilv) August 18, 2022

Sales plunged by 5.9% in July from June, the sixth month in a row of month-to-month declines, and by 20% from a year ago 🚨 pic.twitter.com/cdG9KEf3QG

Saturday, August 6, 2022

7.6% of all the homes for sale have reduced their asking price in the last 4 weeks, per Redfin, $RDFN, the highest amount in 20 years

7.6% of all the homes for sale have reduced their asking price in the last 4 weeks, per Redfin, $RDFN, the highest amount in 20 years.

— unusual_whales (@unusual_whales) August 6, 2022

Sunday, July 31, 2022

job market, is a lagging indicator of a recession

Tuesday, July 26, 2022

Median Home price plunges 9.5% M/M from $402,400, lowest since June 2021 and the biggest drop since 2014

Median Home price plunges 9.5% M/M from $402,400, lowest since June 2021 and the biggest drop since 2014.

— zerohedge (@zerohedge) July 26, 2022

Biden is finally crushing the economy in line with expectations. pic.twitter.com/ndaySeoZr2

BTW, as home sales tank, rental prices on apartments and homes rise. So, good luck with that.

Friday, July 22, 2022

16 of the top 20 states with the lowest unemployment rates are led by Republican governors.

NEW: 16 of the top 20 states with the lowest unemployment rates are led by Republican governors. pic.twitter.com/1JXWZAhxy1

— RNC Research (@RNCResearch) July 22, 2022

Tuesday, June 14, 2022

mortgage rate just hit 6.28% today.

No joke the mortgage rate just hit 6.28% today.

— Kelly Evans (@KellyCNBC) June 14, 2022

Beyond words to express at this point! pic.twitter.com/QEVMdVLXY9

Hordes Of Americans Are Moving To Mexico To Escape Rapidly Rising Inflation In The US

Hordes Of Americans Are Moving To Mexico To Escape Rapidly Rising Inflation In The US https://t.co/K4hHp32w9z

— zerohedge (@zerohedge) June 14, 2022

Monday, June 13, 2022

Colin Keeley: Spend on strategic over non-strategic costs.

Spend on strategic over non-strategic costs.

— Colin Keeley (@ColinKeeley) June 2, 2022

Strategic costs increase the bottom line by bringing in business.

Example: ads, commercializable R&D, salespeople.

For such costs, outspend competitors and spend in good times and bad.

Larry Summers

So, the Architect of Negative Interest Rates is wagging his finger about politics? This is the worst kind of desperate 'consent manufacturing' I've seen yet by shitbag Clintonistas! https://t.co/Jrl1DQBqZt pic.twitter.com/3vndTX4qaO

— Tom Luongo (#2ndAmendmentAir) (@TFL1728) June 13, 2022

June 13, 2022, and the U.S. dollar ain't collapsing

So, how about that collapse of the US Dollar?

— Tom Luongo (#2ndAmendmentAir) (@TFL1728) June 13, 2022

One day soon, so many will understand. pic.twitter.com/ZXQ7SVnzYf

Tuesday, June 7, 2022

Sunday, June 5, 2022

This is why it’s not 2008 all over again this time

This is why it’s not 2008 all over again this time https://t.co/fqCJgt4Mtn

— Tom Luongo (#2ndAmendmentAir) (@TFL1728) June 5, 2022

Tuesday, May 31, 2022

Good time to buy a home? Maybe not

Holy crap, this is quite the chart. pic.twitter.com/x3UFhOPN4F

— Alf (@MacroAlf) May 31, 2022

Tuesday, May 24, 2022

"This is not a transitory problem. This is chronic and systemic"

Monday, May 16, 2022

Keep track of inflation in different sectors

Keep track of inflation in different sectors.

We went from a booming economy to staring down the next recession. Inflation has reached 8.3%, and most Americans are troubled that they will no longer be able to afford their standard of living. According to the latest Gallup poll, 52% reported that they are fearful about maintaining their standard of living. Some may say, “So what? The rich will have to sell off one mansion and fly commercial!” The people who will feel the brunt of this economic downturn are lower-income earners.

Among those earning under $40,000 annually, 73% said they no longer believe they can afford basic living necessities, up from 56% a year prior. About 65% of lower-income Americans worry about having enough money to pay their monthly bills, while 59% say they fear they’ll no longer be able to afford housing. In fact, more lower-income renters should be concerned about the rising cost of housing because landlords will pass their increased costs on to their tenants at a time when rental costs are already at an all-time high.

Medical bills, the leading cause of bankruptcy, are of the utmost concern. Seventy-two percent of lower-income earners said they cannot afford an emergency medical event, and 62% cannot afford basic medical care. These fears are not unfounded and we are looking at a major crisis on the horizon.

Monday, May 9, 2022

Available inventory of homes for sale is rising quickly! 305,000 single family homes on the market, up 4.5% from last week

Available inventory of homes for sale is rising quickly!

— Mike Simonsen 🐉 (@mikesimonsen) May 9, 2022

305,000 single family homes on the market, up 4.5% from last week. Inventory climbing much more rapidly than last year.

This week's @AltosResearch real estate thread and video 👇👇

1/6 pic.twitter.com/Iq6alrCyVm

OVERPRICED MARKETS: VEGAS, BOISE, PHOENIX, & AUSTIN

It's looking a lot like 2007 in Las Vegas and Phoenix pic.twitter.com/05Lm6DfJWi

— Lance Lambert (@NewsLambert) May 9, 2022

Friday, May 6, 2022

Post Office or Excalibur?

If you can get accurate information from the post in just one visit, congratulations, you are better than King Arthur who extracted Excalibur from the forest stone.

I tried to set up a 2nd PO Box. Asking for one, applying for, and paying for one is easy. The USPS will gladly take your money. However if you try to activate it online, the site won't default to your previous po box but to your physical address. If your billing address is your po box, the online app won't recognize it. You'll have to go into the post office and do that in person.

Tuesday, April 26, 2022

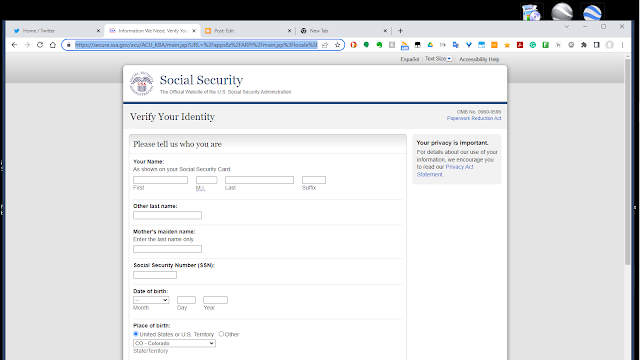

Social Security Benefits

Social Security Estimator is here.

On Tuesday, April 26, 2022, I completed this page.

Terms of Service . . .

- I understand that I may use this service only to access my personal information.

- I understand that this computer program contains U.S. Government information.

- I consent to the monitoring and recording of my use of this program to ensure its appropriate use.

- I understand that it is a federal crime to:

- Give false or misleading statements to obtain information in Social Security records; or

- Deceive the Social Security Administration of an individuals identity.

- I understand that unauthorized use of this service is a misrepresentation of my identity to the federal government and could subject me to criminal or civil penalties, or both.

- I understand that Social Security may stop me from using these services online if it finds or suspects misuse.

Consumer Staples sector is having its best month relative to S&P 500 since August 2001

Consumer Staples sector is having its best month relative to S&P 500 since August 2001

— Liz Ann Sonders (@LizAnnSonders) April 25, 2022

[Past performance is no guarantee of future results] pic.twitter.com/tluh6CcuS8

What is the Consumer Staples sector?

Consumer staples are considered to be non-cyclical, meaning that they are always in demand, year-round, no matter how well the economy is—or is not—performing. As such, consumer staples are impervious to business cycles. Also, people tend to demand consumer staples at a relatively constant level, regardless of their price.

The demand for consumer staples goods remains fairly constant regardless of the state of the economy or the cost of the product.

Saturday, April 16, 2022

Housing Affordability Plunges Nearly 23% In Less Than A Year

— Mike Walgenbach (@mwalgen44) April 16, 2022

Sunday, April 10, 2022

Canada bans foreign home buyers for two years to cool its housing market

Hyperinflation train leaving the station. https://t.co/iKx9yV8SyL

— Jordan Schachtel @ dossier.substack.com (@JordanSchachtel) April 9, 2022

Wednesday, March 23, 2022

Gold prices soar

Gold prices send Thai, Indian buyers into frenzy as war stokes inflation https://t.co/JvR45LqOvi via @scmpnews

— Emerging Markets Capital (@EMC_Asia) March 24, 2022

Average new home sales price rises above $500K for the first time ever

Average new home sales price rises above $500K for the first time ever

— zerohedge (@zerohedge) March 23, 2022

Monday, March 14, 2022

President Manchin Doin' Work. Blocked another fucking Obama Commie from the FOMC board

President Manchin Doin' Work. Blocked another fucking Obama Commie from the FOMC board. Go Go Joe! https://t.co/lWiW3t00fZ

— Tom Luongo (Mr. Ungovernable) (@TFL1728) March 14, 2022

lowest unemployment rates are led by Republican governors.

NEW: 17 of the top 20 states with the lowest unemployment rates are led by Republican governors. pic.twitter.com/aAzFUAU8Sb

— RNC Research (@RNCResearch) March 14, 2022

Sunday, March 13, 2022

"entire streets that were rental houses."

Thank you, Lew Rockwell.

Writes Greg Privette:

Hi Lew,

I read a housing market blog regularly.

The gentleman who runs the blog posts paragraphs from various articles along with links to the original in case you want to read the entire thing. I am seeing article excerpts like the following regularly:

A report from WGHP on North Carolina.

Investment firms are scooping up more and more homes for sale in the Triad. Diane Spivack, a resident of Brightwood Farm, started asking herself who her neighbors were when she saw some people on her street not maintaining their homes or abiding by the HOA code. She quickly discovered more than 100 of the over 600 homes in her neighborhood aren’t owned by a person or family but by a handful of hedge funds and investment groups. The homes are then rented to single families.

After the last housing melt down a lot of the housing stock that had come into being during the late 90’s and early 2000’s wound up being owned by banks and equity firms and became rentals. When I was looking for a new place to rent about five years ago, I found what appeared to be nearly entire streets that were rental houses. They were managed by far off property management firms. The only difference this time is the houses are being bought up ahead of the crash by equity firms. When money is “free” they do not care what they pay. A lot of housing is moving to ownership by these firms. The process is additionally creating a bigger downstream problem by raising the price of houses so the rubes who buy now are even farther underwater than they otherwise would be, making them more susceptible to losing the house during the next crash. Yet more housing stock to wind up in the hands of the banks to be sold off cheap to the equity firms while the taxpayers bail out the banks. A truly viscous cycle with the final result being “You will own nothing and be happy”.

Monday, January 24, 2022

RENTALS INCREASE BY 3.6% ACROSS THE U.S.

Freddie Mac’s annual Multifamily Outlook report foresees rent rising by

3.6% across the US in 2022. “Given the robust demand for housing this year, we

believe that upward price pressure for both rental and for-sale housing will

continue in the short term as we continue to experience an overall housing

shortage across all housing types,” the report noted. Furthermore, as CPI data

is lagged, the sharp increase in rent prices has not fully factored in

inflation. “We believe the sharp increase in housing costs captured by the CPI

over the past two months is likely just the beginning.”

The report stated that consumers

believe inflation will decline over the next five years, but expectations for

2022 have increased by 50 bps to 3%. For the 12 months ending in October 2021,

rents increased 14.9% on average. The report noted additional contributing

factors for rising demand:

Renters who would have moved last

year who did not due to the pandemic

Two years’ worth of college

graduates who are leaving home for the first time

Professionally managed units (which

this data is derived from) were more able to adapt to changing conditions

brought on by the pandemic than smaller operators and therefore more likely to

capture the demand than smaller operators

A reallocation of budget toward

housing from government stimulus or cutting other expenses during the pandemic

Former roommates choosing to live

on their own

High-density areas that already

experienced a pandemic exodus are expected to have the lowest growth rates.

Rent is expected to drastically rise above the national average in the

following cities:

Phoenix: 7.6%

Las Vegas: 7.0%

Tampa, Fla.: 6.9%

Tuscon, Ariz.: 6.5%

Albuquerque, N.M.: 6.2%

Atlanta: 5.9%

Sacramento, Calif.: 5.8%

Riverside, Calif.: 5.7%

West Palm Beach, Fla.: 5.5%

Fort Lauderdale, Fla.: 5.2%

Wednesday, January 19, 2022

African Americans are moving out of the cities that their parents and grandparents fled to during Jim Crow

African Americans are moving out of the cities that their parents and grandparents fled to during Jim Crow and into the South‘s booming metropolises.

— The Washington Post (@washingtonpost) January 19, 2022

Some are calling it the new Great Migration. https://t.co/q2446lWQ3x